Monthly Report, January 2026

- Jan 4

- 3 min read

Editorial

Trump seeking permanent chaos

Over the past year, he has reshaped the world order.

The US's desire to control the West side of the world.

The US has only cut off the head of the Maduro regime.

What consequences can we expect for the markets?

A new geopolitical shock that the world could have done without, orchestrated without congressional approval by an uncontrollable American president. The idea of Venezuelan oil flooding the markets will remain a fantasy for the next 10 years.

- by Kim Muller, CIO (Switzerland)

Assessment of the economic situation

Overall economic growth will remain within the norm in 2026. Inflation has stopped falling but could be disrupted by a potential surge in commodity prices. Central banks remain vigilant.

Overall economic growth within the norm.

Do not confuse reserves with oil production.

Fed cuts rates, BoJ raises rates, ECB remains stable.

What about the SNB's monetary policy?

After hovering around the 0.94 level in December, the EUR/CHF of its primary objective, which is price stability in Switzerland. pair finally closed the year just above the 0.93 level, at 0.9309, According to the KOF, the Swiss economy is expected to grow by likely thanks to a little "help" from the SNB. While our central bank 1.1% this year and 1.7% in 2027, which should help avoid negative remains vigilant about the franc's performance, it has not lost sight interest rates in 2026.

Financial markets during the month

Despite all the hype surrounding Al, the US stock market underperformed international indices in 2025. Conversely, long-term USD bonds outperformed those of other developed countries.

US stocks underperformed despite Al.

10-year yields scattered in 2025.

The Silver and gold top, orange juice and cocoa flop.

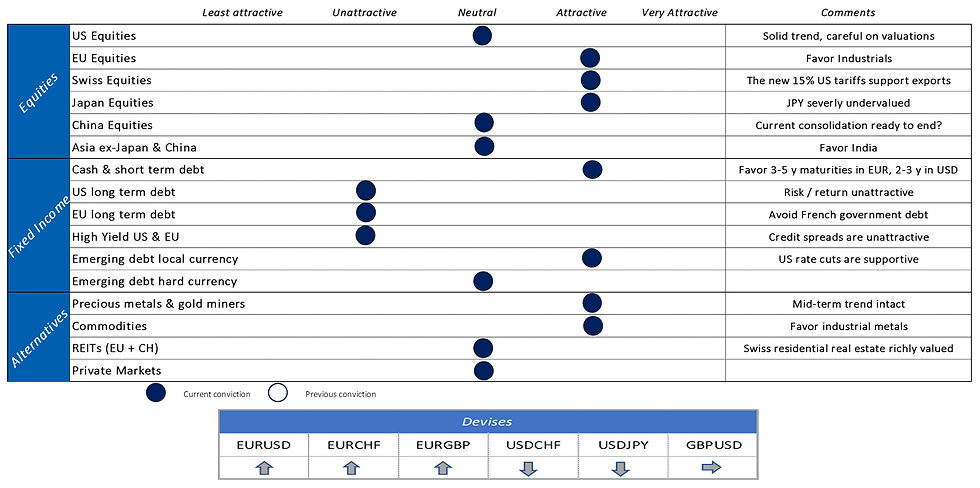

Our convictions

Comments on investment decisions

The years go by, but they are not necessarily alike. The current dynamic remains favorable for equities, but complacency looms given the strong positive consensus. Inflation appears to be under control at this stage, but a surge in commodity prices cannot be ruled out, especially as the geopolitical situation remains highly uncertain.

Equities.

Bonds.

Precious metals and listed real estate (REITs).

Currencies.

Performance Summary

Equity.

Bonds, currencies and commodities.

Disclaimer

This document has been prepared using sources believed to be reliable but should not be assumed to be accurate or complete. The statements and opinions it incorporates were formed after careful consideration and may be subject to change without notice. The author and distributors of this document expressly disclaim any and all liability for inaccuracies it may contain and shall not be held liable for any damage that may result from any use of the information presented herein. Past performance is not indicative of future results. Values of an investment may fall as well as rise. This document is intended for information purposes only and should not be construed as a recommendation, an offer, or the solicitation of an offer to buy or sell any investment products or services. The use of any information contained in this document shall be at the sole discretion and risk of the user. Prior to making any investment or financial decisions, an investor should seek individualized advice from his/her financial, legal, and tax advisors that consider all of the particular facts and circumstances of an investor's own situation.

DIFC: This document is directed at Professional Clients as defined under the rules and regulations of the Dubai Financial Services Authority (DFSA). Probus Pleion Middle East Limited is regulated by the DFSA.

Switzerland: This document is directed at Professional Clients and/or Qualified Investors as defined under the rules and regulations of the Swiss Financial Market Supervisory Authority (FINMA). Probus Pleion Suisse SA is regulated by the FINMA.

Mauritius: This document is directed at Professional Clients and/or Qualified Investors as defined under the rules and regulations of the Financial Services Commission (FSC).

Luxembourg: This document is directed at Professional Clients and/or Qualified Investors as defined under the rules and regulations of the Grand-Duchy of Luxembourg. Clients’ data is protected under the REGULATION (EU) 2016/679 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data and repealing Directive 95/46/EC (General Data Protection Regulation).

Data Privacy Policy Important Notice: Companies within the Probus Pleion Group recognise the importance of keeping the personal data of its customers and other counter-parties confidential and protecting their privacy rights. While each company within the Probus Pleion Group has its own privacy policy in accordance with the applicable standards, you may access Probus Pleion Group global privacy policy at the following URL: https://www.probuspleion.com/data-protection-policy